The NGO certificate awarded to Pestalozzi Children's Education Society recognizes its dedication to providing quality education and holistic development to underprivileged children. This certification acknowledges the society's compliance with legal standards and its impactful work in transforming lives through education and support for disadvantaged communities.

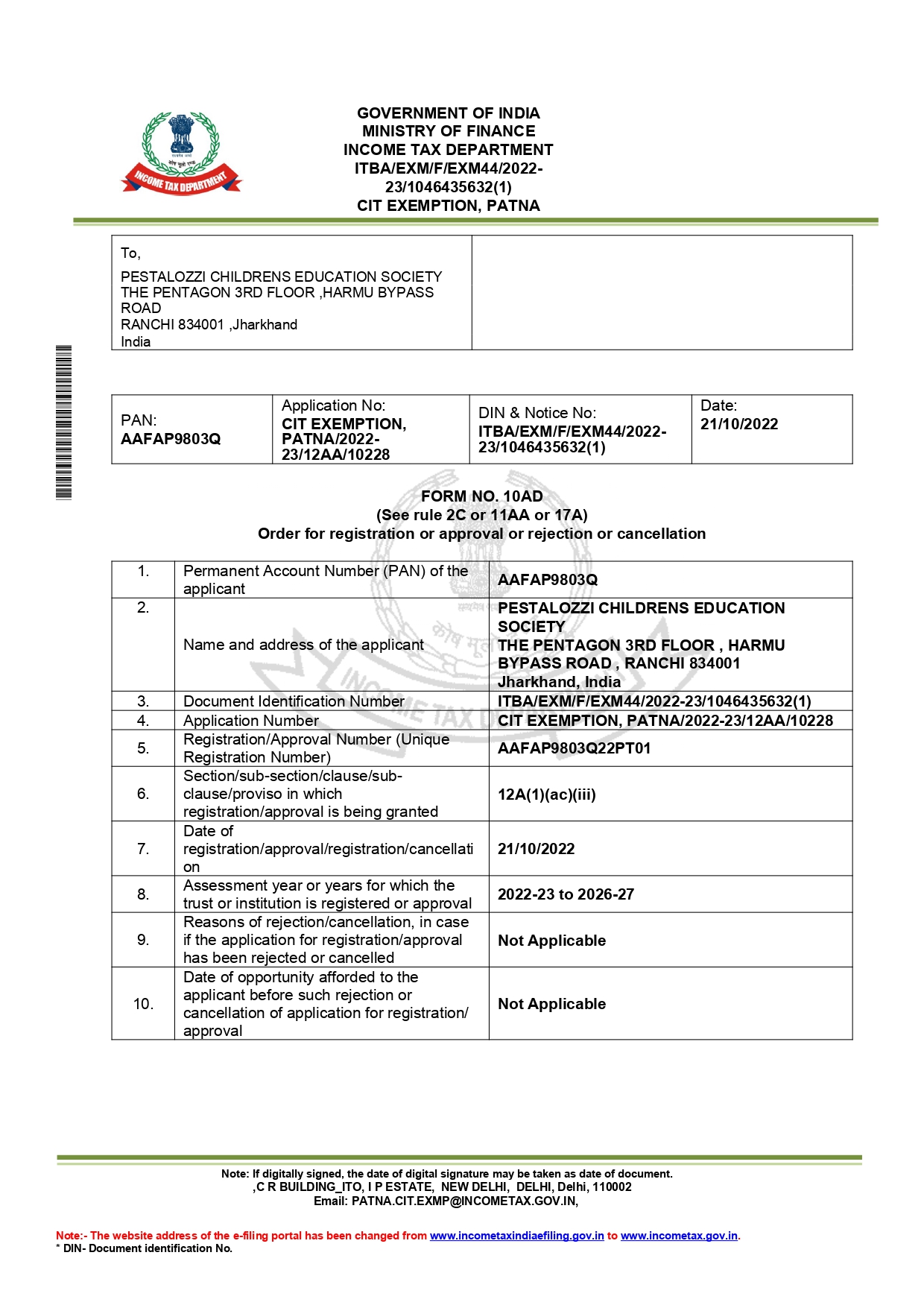

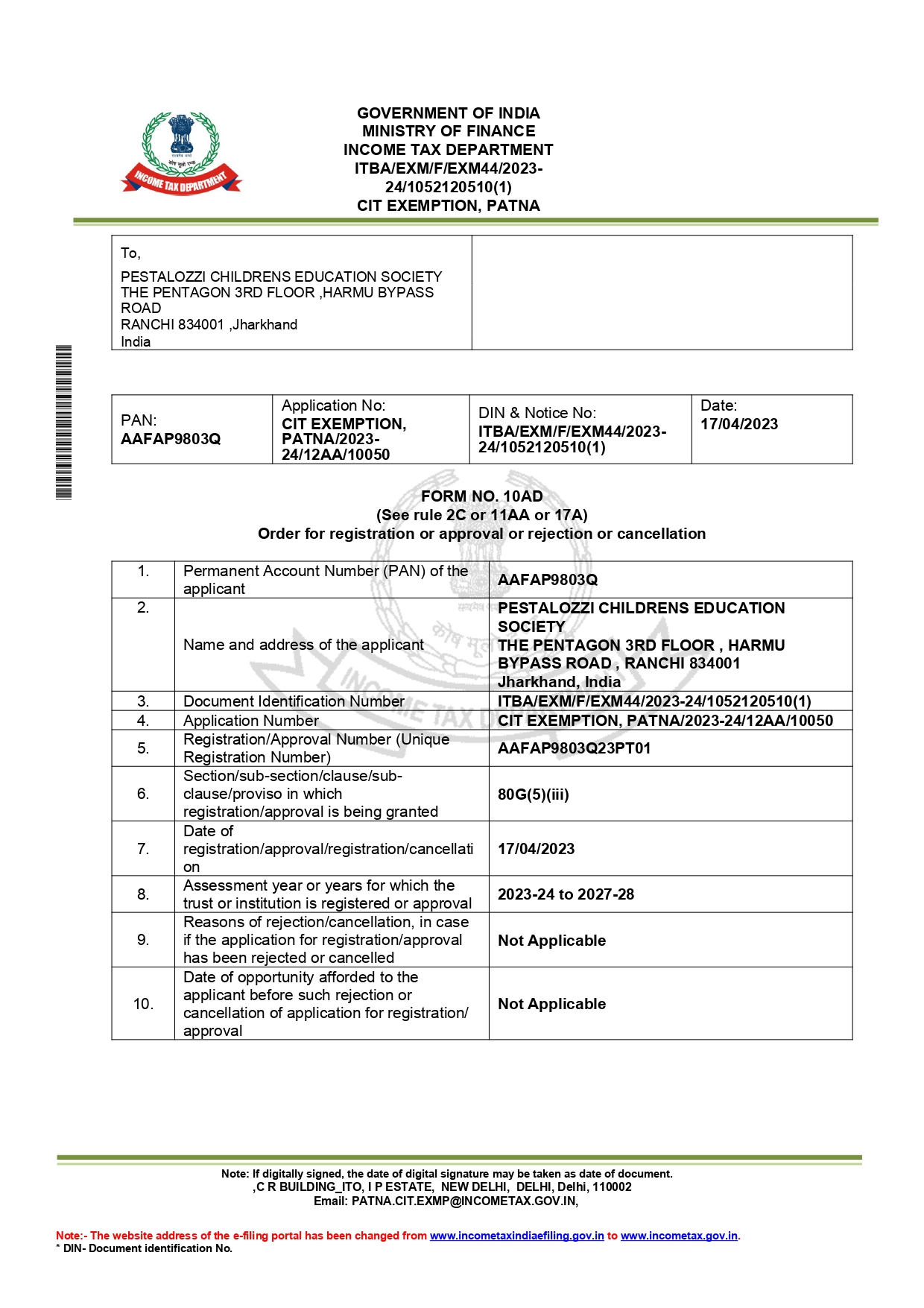

Form 80G

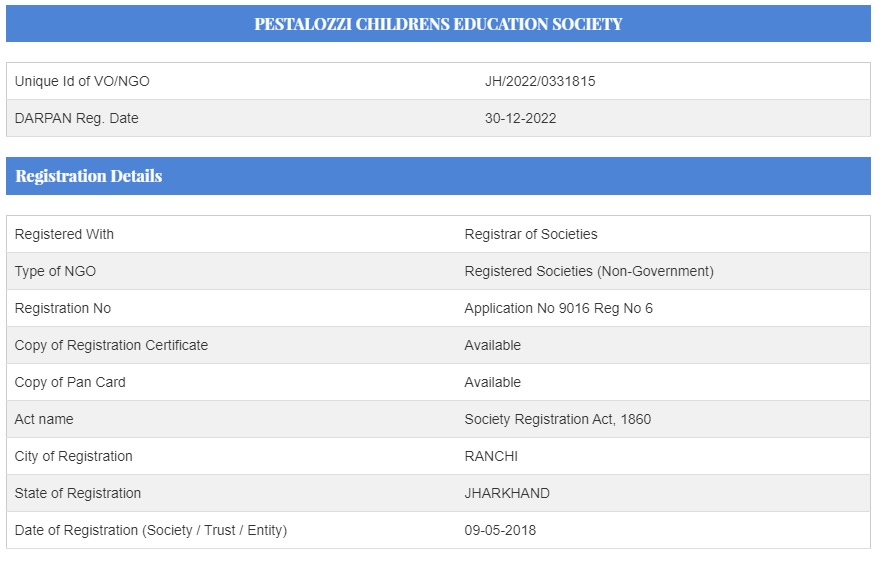

Niti Aayog

PAN Card

Eligibility to claim deduction under Section 80G

The following taxpayer can claim a deduction under this section:

* Individuals

* Companies

* Firms

* Hindu Undivided Firm (HUF)

* Non-Resident Indian (NRI)

* Any other person

* Individuals

* Companies

* Firms

* Hindu Undivided Firm (HUF)

* Non-Resident Indian (NRI)

* Any other person

How to claim the deduction under Section 80G?

To claim this deduction, the following details must be provided in your income tax return:

- Name of the donee

- PAN of the donee

- Address of the donee

- Amount of contribution, with a breakdown of contributions made in cash and other modes

- The amount eligible for deduction

These details should be entered in the corresponding tables in the ITR: - Table A: Donations eligible for 100% deduction without a qualifying limit - Table B: Donations eligible for 50% deduction without a qualifying limit - Table C: Donations eligible for 100% deduction subject to a qualifying limit - Table D: Donations eligible for 50% deduction subject to a qualifying limit

- Name of the donee

- PAN of the donee

- Address of the donee

- Amount of contribution, with a breakdown of contributions made in cash and other modes

- The amount eligible for deduction

These details should be entered in the corresponding tables in the ITR: - Table A: Donations eligible for 100% deduction without a qualifying limit - Table B: Donations eligible for 50% deduction without a qualifying limit - Table C: Donations eligible for 100% deduction subject to a qualifying limit - Table D: Donations eligible for 50% deduction subject to a qualifying limit

What is the mode of payment under Section 80G?

Section 80G deductions can be claimed by the taxpayers for donations made through the following:

- Cheque

- Demand draft

- Cash (donation of Rs 2,000 or less)

Note: Donations made in kind, like food, materials, clothes, medicines, and over Rs 2,000 in cash, mean not by way of an account payee cheque/draft, are not eligible for deduction u/s 80G.

Donations under Sec 80G exceeding Rs 2,000 are accepted only if you pay through any mode other than cash.

Partially or fully, 100 % or 50%, deductions for donations enlisted in Sec 80G could also be limited or unlimited.

- Cheque

- Demand draft

- Cash (donation of Rs 2,000 or less)

Note: Donations made in kind, like food, materials, clothes, medicines, and over Rs 2,000 in cash, mean not by way of an account payee cheque/draft, are not eligible for deduction u/s 80G.

Donations under Sec 80G exceeding Rs 2,000 are accepted only if you pay through any mode other than cash.

Partially or fully, 100 % or 50%, deductions for donations enlisted in Sec 80G could also be limited or unlimited.

FORM 12 A